Award-winning PDF software

2022 IRS 1040 Bridgeport Connecticut: What You Should Know

However, as noted earlier, it is necessary to wait until the October 10, 2022, tax filing date before completing any forms. The calendar year 2025 ends on October 10, 2022, after the November 2, 2022, Tax Day. On that day, all business must close. In general, tax preparation must be done by the end of October. However, in some cases, the due date to file can be delayed. Tax Exempt Organizations — CT.gov Dollar Distribution Due Dates — Tax Exempt Organizations There is no way to accurately predict the date of the last day the government may distribute 1,000 of money. However, all agencies expect the distribution to occur between October 10 and the close of business on the following day. This is to ensure that taxpayers with large distributions receive their money by the close of business. For the benefit of individuals, the distributions of public funds and public property are based on the date on which these entities are organized under the laws of Connecticut. When a tax-exempt organization becomes the agent for an individual in a tax liability or estate tax recovery, the organization, or its legal representatives, typically contact the Tax Division by telephone on a daily basis to advise of any changes. If the organization no longer wishes or is unable to act as agent on behalf of the individual, it will not make distributions by the end of the calendar year of the change-of-agent year. Publicly Funded Education — CT.gov Form CT-2022 (Publicly Funded Education — 1040NR) Dateline, October 14, 2019, Degree or Certificate Programs and Degree Programs (Graduate) with a Baccalaureate Degree — Connecticut If you are interested in enrolling in a degree or certificate program, your tax professional will review your tax return to determine whether the programs or degree have been approved for credit by the Department of Financial Services through the Connecticut Higher Education Coordinating board. Once approved and paid for, the program will be assigned a CT-2022 tax identifier which will provide the program's name, location, and its credit status. Tuition and Fee-paid Programs If you are enrolling in a tuition-paying program, the tax professional will review your tax return to determine if your amount of tuition is the same or a higher amount than it was prior to enrol and will confirm that a tuition payment that is based on the current tuition and fees is due upon graduation.

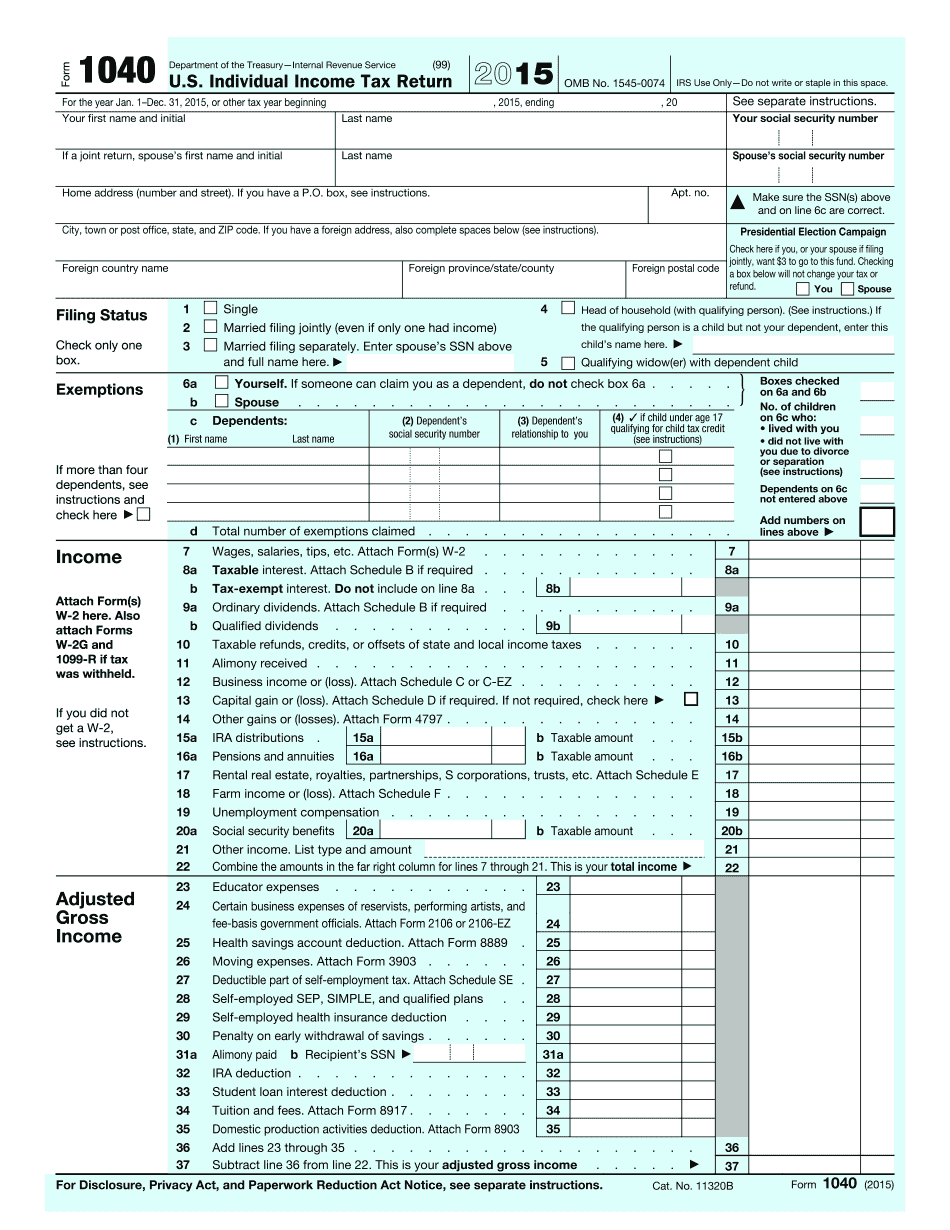

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040 Bridgeport Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040 Bridgeport Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040 Bridgeport Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040 Bridgeport Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.