Award-winning PDF software

2022 IRS 1040 for Palmdale California: What You Should Know

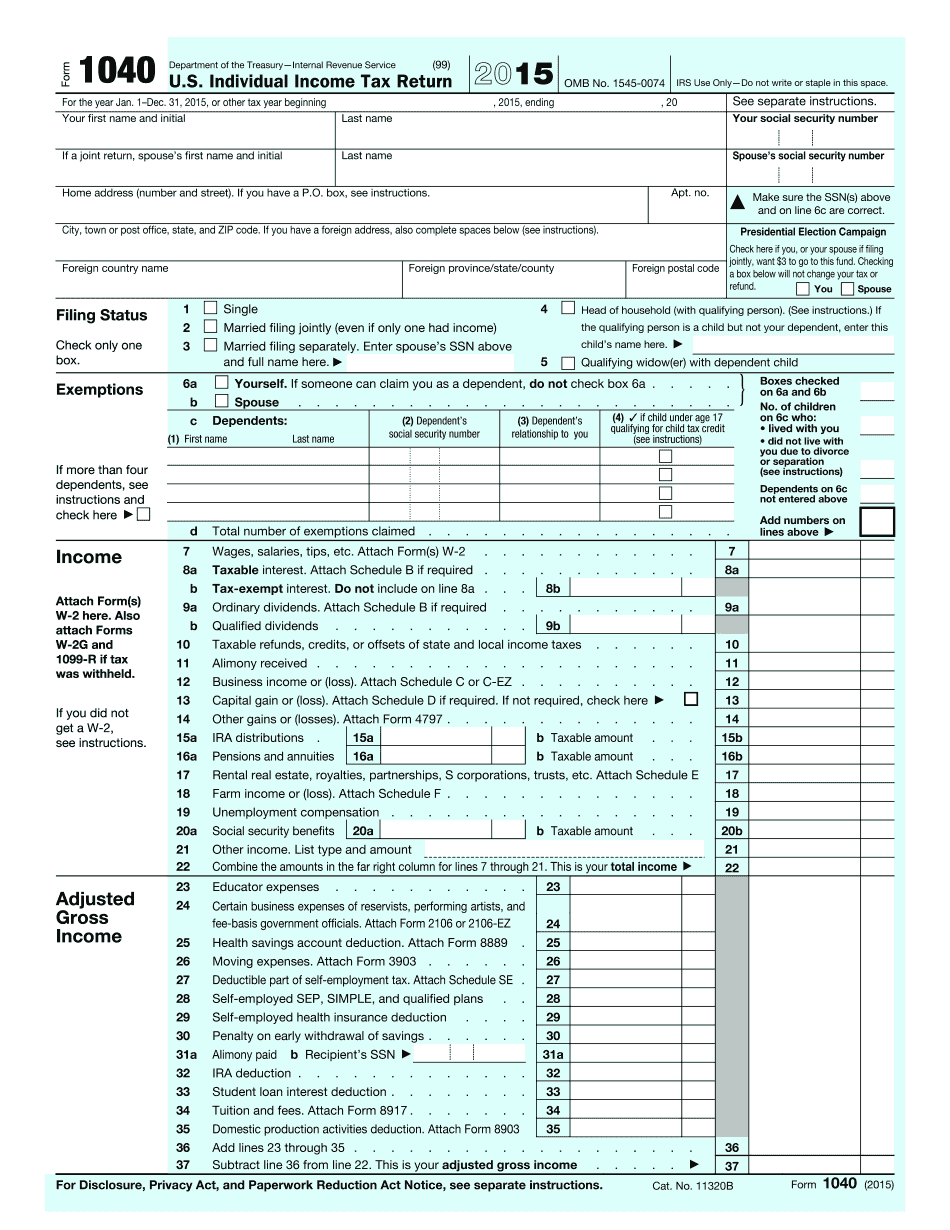

U.S. Individual Income Tax Return The information on this page is intended to provide general guidance on Form 1040-C and not the official rules and regulations of the Internal Revenue Service. U.S. Individual Income Tax Return is a return (or statement) that a taxpayer wants to file with the Internal Revenue Service (IRS) on Form 1040C. Form 1040-C is a one-page U.S. tax return that is used by individuals or companies to report the following information to the IRS: the total income tax due the payment of refunds -- or the refund of additional tax; all tax withheld, or tax withheld at source the gross income and any deductions or credits that are claimed, the earned income and other sources of income, medical expenses, spousal support, reimbursed employment expenses, property taxes, payments required under the Foreign Account Tax Compliance Act (FATWA), child support, wages, student loan interest, disposition of certain types of property. Form 1040-C and 1040-NR provide reporting options on Form 1040NR and Form 1040NR-F1 for certain additional types of income. In addition, Form 1040NR-F2 and 1040NR-F3 are used by certain individuals to indicate the disposition of a qualified estate. Qualified Estate means all property that passes from one generation of a family, or estates that consist of, or pass through, at least a decedent's qualified descendants (stepchildren or siblings) to whom the decedent was married and who are, at least 70½ percent related to that decedent. See section 519(p) of the Internal Revenue Code. If there is a qualified estate but no qualified descendants, the decedent could not benefit from the estate tax exclusion because there was no qualified descendants. Unrelated Spouse A qualified spouse is “unrelated” if the taxpayer is married to someone else. See section 7703(b), 609(b), and 10105 of the Internal Revenue Code. Because a couple is related by only one person's filing status, this provision may not apply to one or both of the parties. Reporting Timely All 2025 returns should be mailed to: Internal Revenue Service Attn: Taxpayer Assistance Center P.O.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040 for Palmdale California, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040 for Palmdale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040 for Palmdale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040 for Palmdale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.