Award-winning PDF software

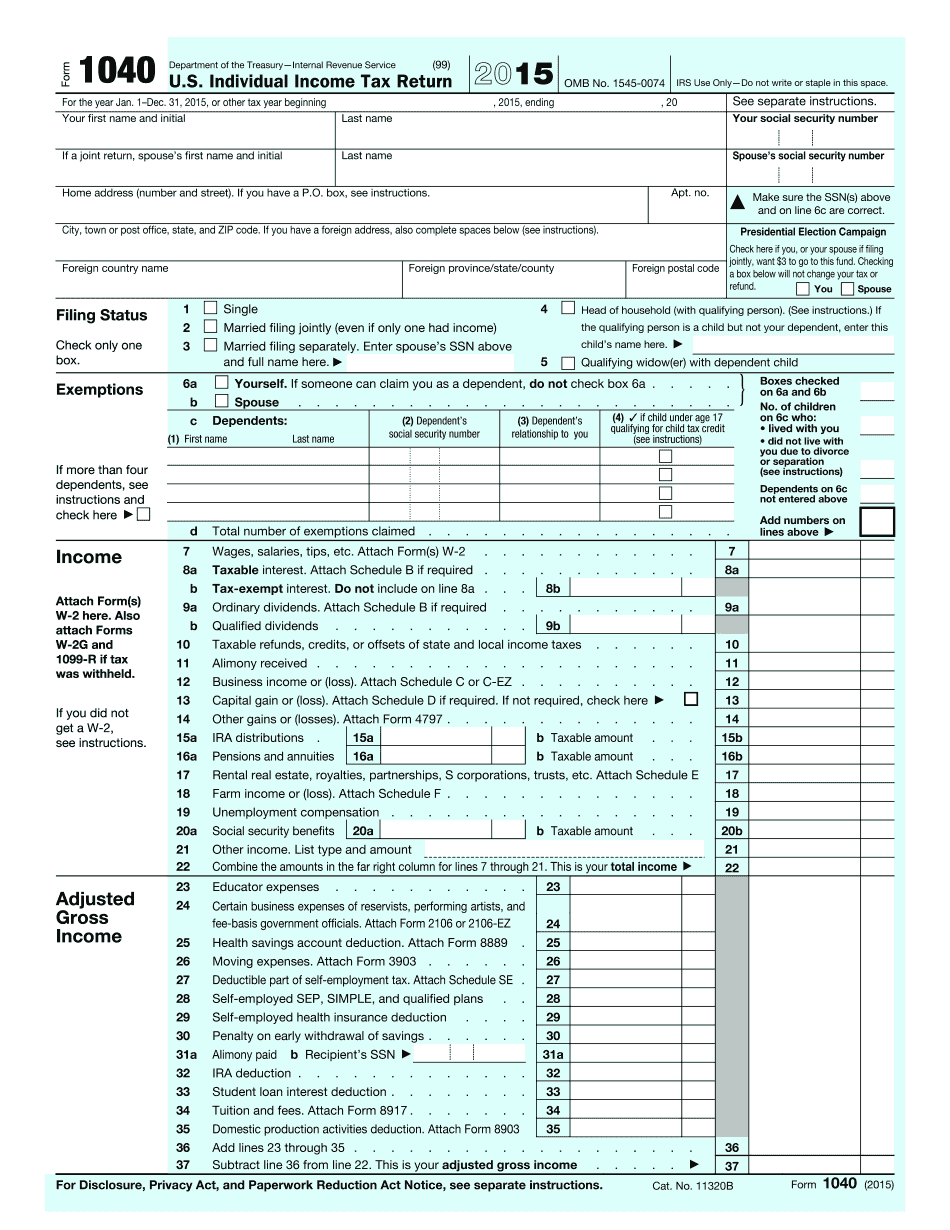

2022 IRS 1040 for Tampa Florida: What You Should Know

The event is hosted by the IRS and attended by tax professionals and representatives from Andes Tax The IRS provides the following workshops and meetings: Tax Topics for Tax Professionals: A Taxpayer's Guide to 29 May 2025 — This webinar will provide individuals and couples the tips and tools they need to get more out of their tax accounts with the release of IRS's publication, Tax Matters for Individuals and Businesses, which provides advice in the areas of the new tax filing requirements, filing status changes, preparing tax returns, tax prep and preparing tax returns for the 2018 tax year, and the filing, accounting and reporting of taxes for the 2017 tax year. Learn More A Guide to Assessing Tax Liens 8 May 2025 — For individuals with property taxes or liens, this guide will provide a step-by-step guide to assess and pay what is due and help individuals understand how liens are managed and what rights they are entitled to. This guide also provides guidance on what to do with taxes in liens that have been modified, which can be confusing. The guide will cover a range of topics including identifying tax liens, assessment procedures, and paying the liens. A Guide to Assessing Property Liens 30 Apr 2018—The Tax Cuts and Jobs Act increases the maximum tax credit for property that has been purchased and improved and modified for use as a rental or sale, and lowers the maximum credit that can be extended to a subsequent modification. This guide will provide guidance on the maximum tax credit for tax-exempt property and will not include guidance on properties acquired and modified for use as rental and sale or as a business. A Guide to Assessing Credit for Improvements 28 Sep 2017—This guide has information on evaluating and applying changes to property value based on changes in the value of any property owned by a person. Property owners who file a tax return need to know the rules for calculating the amount of the credit or refund based on any changes in the value of property. This guide provides general or specific information on assessing and applying any valuation changes. A Guide to Understanding Income From Sale of Real Property 23 Sep 2017—The Tax Act of 2025 increases the maximum credit for property that has been purchased and improved and modified for use as a rental or sale, and lowers the maximum credit that can be extended to a subsequent modification.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040 for Tampa Florida, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040 for Tampa Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040 for Tampa Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040 for Tampa Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.