Award-winning PDF software

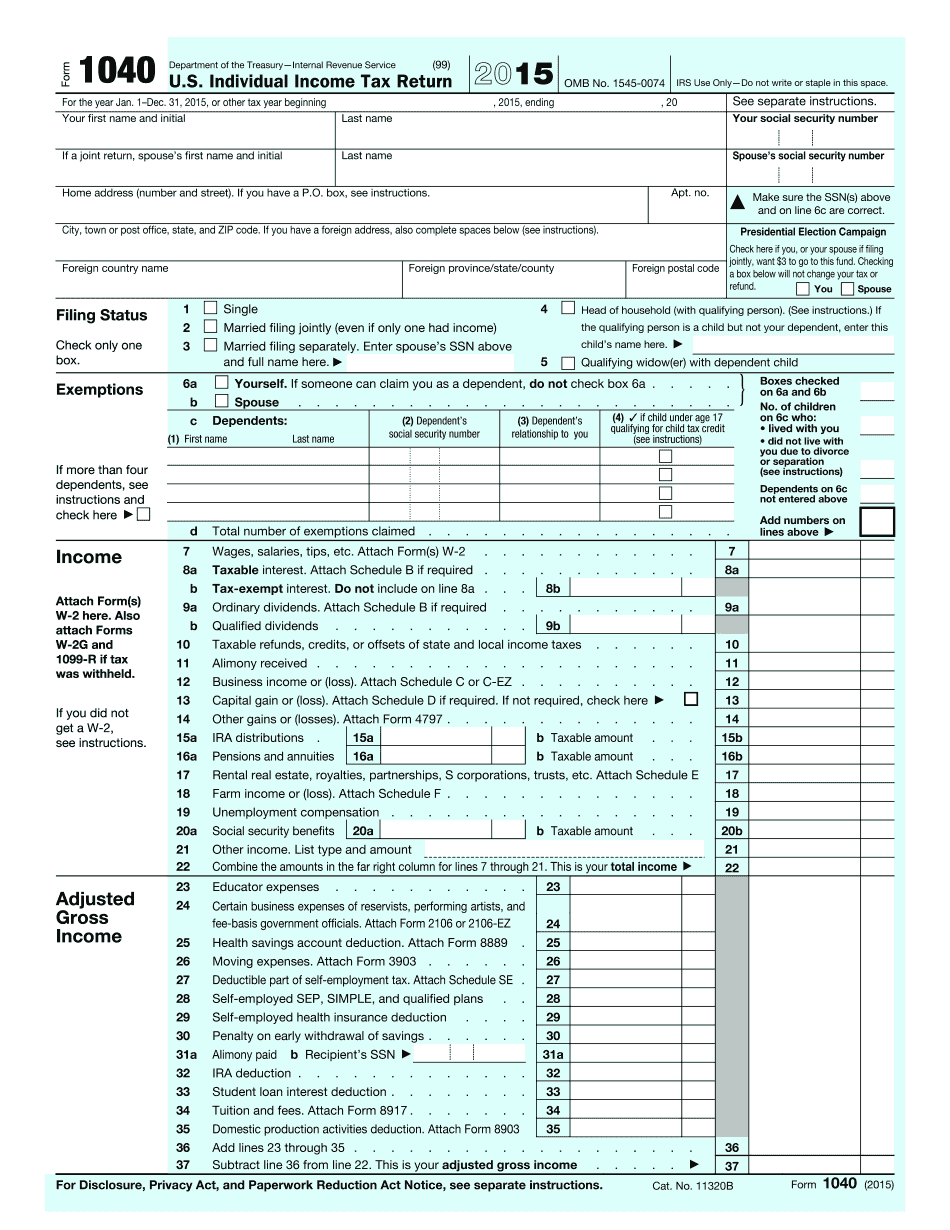

2022 IRS 1040 online South Fulton Georgia: What You Should Know

Residents determine your rights under the Georgia Home Rule Charter and if applicable, the Home Rule Act, and their rights and obligations under the Homestead Exemption Code. This publication will assist you in understanding the exemptions allowed under Fulton County Home Rule Charter and the Home Rule act. If you don't have any specific questions about the homestead exemptions or the Georgia Home Rule Act, you may call the Fulton County Treasurer's Office at or fill out a request for a homestead exemption handout. This publication will continue to be updated as the situation changes. Georgia Sales Tax Exemption Guide On a typical home purchase or sale, a taxable sale, the sales tax usually applies. Georgia state sales tax rates are 1.5 percent (6 percent if in a county with a population over 1 million) on sales less than 700.75 and 7 percent (8 percent in a county with a population over 1 million) for sales in excess of 700.75 except when the sale is a grocery sale. For more details on Georgia sales tax and how your purchases may be subject to sales tax in Georgia, please reference the Georgia Sales Tax Overview. Also, as noted below, under Georgia state law, the following sales will be exempt from sales tax: (1) goods sold at fair prices; (2) supplies for use or consumption if supplied by the vendor; (3) supplies provided by the vendor at the vendor's expense; (4) a purchase at wholesale by an individual; (5) (i) sales on a farm and by farm employees, the farm manager, or related farm management agencies; and (ii) sales at farmers' sales and fairs; and (6) (i) sales at a county fair, golf course, agricultural fair, or agricultural trade fair, where the fair is operated, supervised, or controlled by the Georgia Department of Agriculture. On a home improvement sale, the sales price must be equal to or greater than the cost of repairs made to the home. Home Improvement Sales Exemption (GA Code 13-14-711) As a salesperson for an applicant, it is important from the beginning to be certain that the applicant and the salesperson are eligible to purchase the home. If the applicant is a “self-employed person” or a “person holding a license to conduct a business” (GA Code 13-14-711.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040 online South Fulton Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040 online South Fulton Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040 online South Fulton Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040 online South Fulton Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.