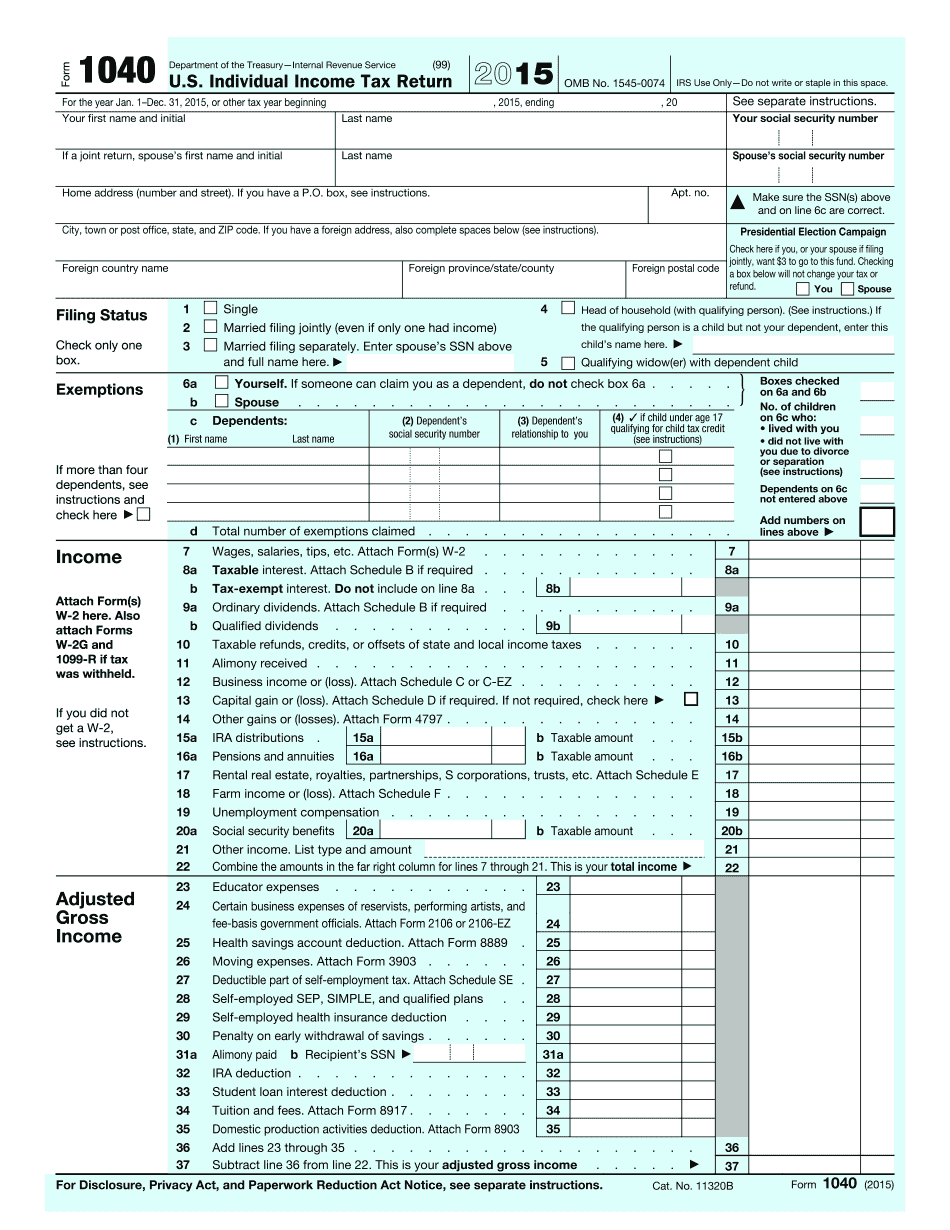

This is Mr. Ikenson and in this lesson, I'm going to talk to you about filling out a 1040 EZ tax return form. This is the most basic tax return form that you can use personally to fill out a tax return at the end of the fiscal year to submit to the IRS, to record your earnings and receive a refund, or unfortunately, maybe even have to pay more taxes. So, this is what the form looks like. It's very simple. It's actually two pages. You have the main component here where you'll enter all your information, and then you have some instruction sheets on the back as well. We're not really going to get into this. I'm just going to walk you through this main page here. So, we'll be entering information into this form here. I have a tax scenario for you that you'll have when you complete this, and that is going to be a little bit like this one here. This is a W-2. This is something that your employer will mail to you at the end of the fiscal year. Usually comes in January or February, sometime, and it has all of your employer and employee information listed, including your gross wages and taxable income, and all the tax that was withheld from your paycheck, money you didn't even see, from the federal government, from the state government down here, and from the local government or municipality. So, just a brief walkthrough on this. You can see that we've got the employer's information name here and their address. We've got the employee's information down here starting with the social security number, their first name, middle initial, last name, street address, city, state, and zip code. And then, going over, starting with one, it lists...

Award-winning PDF software

2015 1040ez Form: What You Should Know

You need to do this to show in a court (and state tax officials) whether any tax is due on the sale of the mobile home. If you don't do this, any transfer from the seller to the buyer will be considered a sale of the mobile home to a person who lived in the unit at the time of the sale and did not do anything, such as a renovation or maintenance work, for the unit after the sale. If the seller sells the purchased manufactured home to a non-connected buyer, the seller will need to complete a Bill of Sale, Certification of Retail Value and Purchase Price. You can get a copy of the Bill of Sale here California County Tax Clearing Certificate for Mobile Homes in California, dated January 1st, 2025 (This is the date it will be filed) · If you are transferring the mobile home to a non-connected buyer, you may also find it helpful to complete a Certificate of Occupancy as a form of insurance in case your mobile home gets sold to someone who had no connection to the home in terms of ownership. NOTE : All of these forms can be obtained through a county Clerk's office, by visiting their website or at a county tax office or online: Note: You can download the form by going to. When do I need to give notice? If you sell or transfer your property for value over 2,500, and the property is a mobile home (whether manufactured or manufactured) then you must give the buyer 24 hours' notice. If the buyer requests an extension, you need to either give the buyer a new offer within this deadline or give them 30 days notice. Otherwise, the buyer gets a refund of the purchase price. California's law requires the notice be at least 10 days before the sale or transfer and at least 48 hours before delivery of the property. You do have a choice if you are giving notice by mail or e-mail: you need to provide a certified statement of the proposed sale as well as the amount of the purchase price not to exceed 2,500. You can also offer a price in excess of 2,500, if the buyer agrees to the offer.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1040, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1040 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1040 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1040 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 form 1040ez