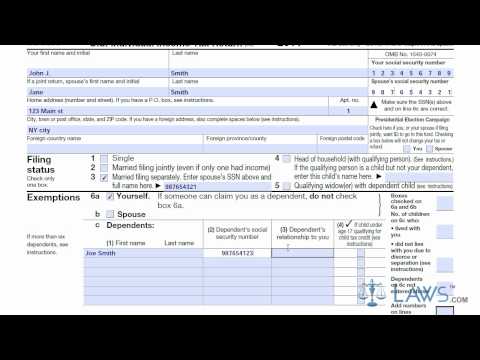

Laws.com legal forms guide Form 1040a is a United States Internal Revenue Service tax form used for filing an individual's tax return. It is a short form, as it is a cut-down version of the long 1040. It can be used by individuals who do not make more than $100,000 and do not itemize their deductions. The Form 1040a can be obtained through the IRS website or by obtaining the documents through a local tax office. The tax form is to be filed by the taxpayer at the end of the taxable year. First, enter all of your personal information in the top set of spaces on the form. Include your name and social security number. If you are filing a joint return, you must also include your spouse's name and social security number. State your contact information, putting your address and foreign nation information if residing outside of the United States. Indicate your filing status in the proper below your contact information. If married and filing separately, you must put your spouse's Social Security number. Next, fill out the exemptions, claiming yourself, a spouse, and any dependents you are claiming. List all dependents' names, Social Security numbers, relationship to you, and check if they are under the age of 17. Indicate the total number of exemptions in line 6. Write in all income obtained through the taxable year. Include wages, salary, taxable interest, ordinary dividends, capital gains, IRA distributions, pensions, unemployment, and Social Security benefits. Add all of these amounts as instructed and state your total income in line 15. Determine your total adjustments following the tax instructions. Enter your educator expenses, IRA deductions, student loan interest deductions, and tuition and fees. Add these totals together and subtract from your total income. This will determine your adjusted gross income. Next, you must determine all...

Award-winning PDF software

2015 1040a Form: What You Should Know

In Wisconsin, the real estate transfer law is administered by the Department of Financial Institutions. You can file documents with them directly, or through an agent. The application for a deed of trust is filed online by filing the property tax and personal property tax forms through the Wisconsin Taxpayer Assistance Center (WI TAC). WI TAC serves the legal needs of Wisconsin residents who do not want or need to take part in the cumbersome process of filing for a deed of trust by mail or in person. The forms and documents covered under this Guide include all the forms (including the title affidavit) necessary to complete a deed of trust in Wisconsin. In some instances, the Wisconsin Department of Financial Institutions will mail you these documents for a fee. Deed of Trusts in Wisconsin (WI TAC) Wisconsin Register of Deeds Association (GREG) — Application for Deeds of Trust Wisconsin Register of Deeds Associations (GREG) — Application for Renewal of a Deed of Trust Deed of Trust and Trustee Agreement (Wisconsin Reg: 801.01) A trust deed is the legal document used to make a transfer of property ownership. The deed sets out who exactly owns the property, what they own to what extent, and the specific terms of the agreement that is created between the parties, if any. The granter (the original owner) and the settler (the transferor) agree to give the legal title to the property to whoever makes the trust. The settler is also entitled to the land if the trust is not terminated on or after the expiration of the grant. The trust deed is a type of instrument that a settler, in exchange for the deed, gives up the legal title to the property to the transferor for good faith payment to the granter of an amount equal to the fair market value of that property at the time of the exchange, or at the time of the transfer, whichever is sooner. Trust deed (WI TAC) and Trustee Agreement (GREG) Legal forms Deed of Trust to Beneficiary A deed of trust must be executed in a court of law, and must contain certain documents. The most important documents are the consent of the settler and a written agreement from the settler signed by both parties.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1040, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1040 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1040 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1040 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 1040a