Award-winning PDF software

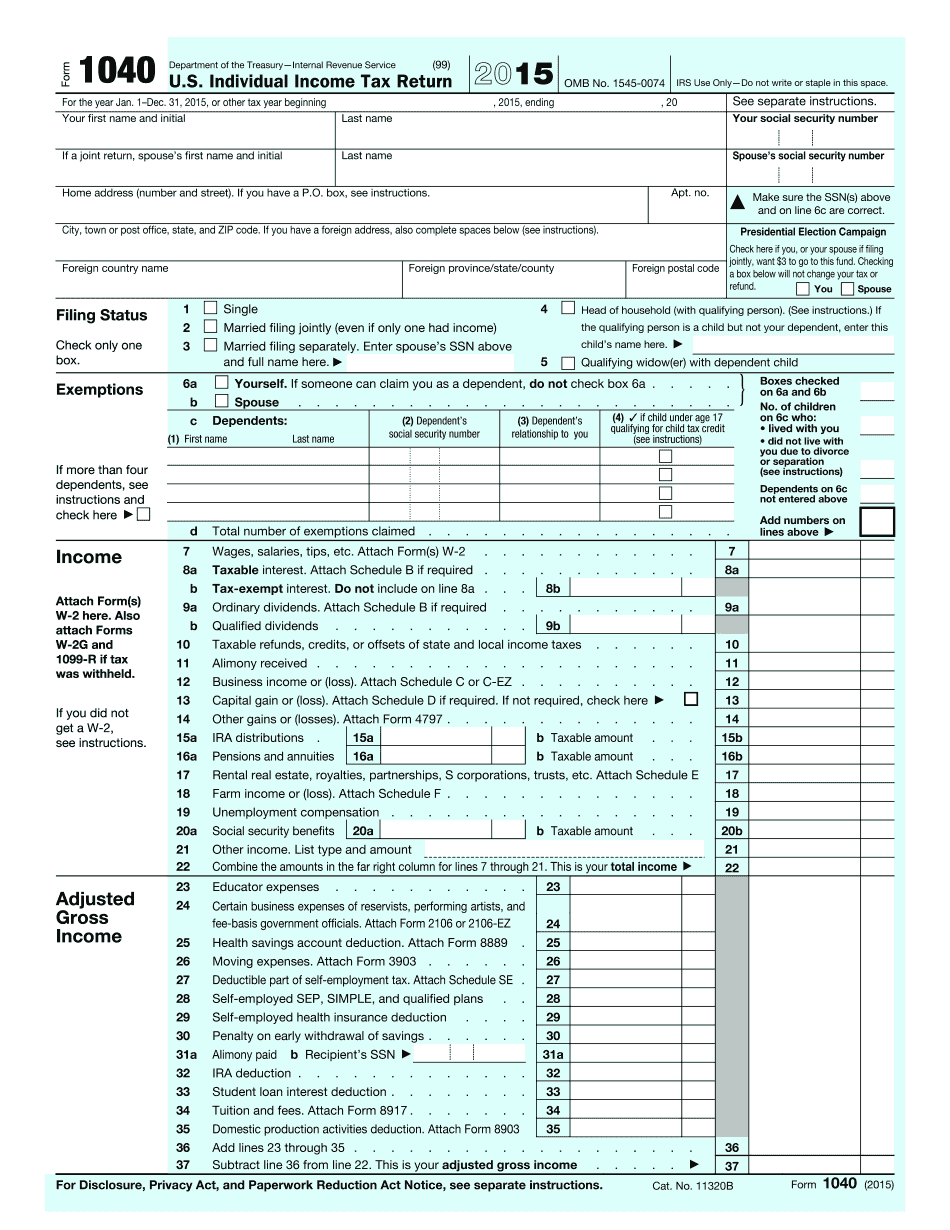

Jacksonville Florida 2025 IRS 1040: What You Should Know

Get a Free Payment Plan | Internal Revenue Service If your Tax Bill Is More Than 500, The IRS offers special offers and low monthly installment payments through annual installment plans. If you choose a Payment Agreement, you may not pay interest on any amount in excess of 500, and there will be no penalties. After making your payment, if the payment agreement is in full force and effect, your Tax Bill will not be less than 500. If your payment agreement is in partial force and effect, the payment agreement must be in full force and effect. If your payment agreement is less than full force and effect, that amount will accumulate interest and penalties, and may be collected via IRS Collection as the law allows. Payment agreements are only available to the following income, social security, Medicare, Health Services, and Social Security disability payments. Also, not available are the following: Child support payments; Treatment for veterans; and Payments received as a result of a federal estate tax. Taxpayer Assistance | IRS Sep 29, 2022- Schedule F, Line 23, Tax Table — Florida Mar 15, 2023- Schedule H, Schedules for Florida — IRS Apr 04, 2024- Tax Calculator — Taxpayer Assistance Department Jun 30, 2025 — Schedule S, Return for Florida — IRS If the answer to any of the questions above are “yes”, it may be your Income Tax Filing Deadline. If your filing deadline is due before a specific date, you will receive an IRS letter advising you what to do. If you owe back taxes, you can pay your taxes, get a refund, or claim credits against your taxable income. Learn the Florida Income Tax Laws and Prepare a Free Florida Income Tax Return See a Free Tax Guide and Free Seminole State University Press e-Edition of my free 5-Step Tax Return Guide for Florida Residents See my Florida State of Florida Free Phone Self-Help Guide to Fill out Florida Tax Returns See More About My Florida Tax Help and Free Seminole State University Press Books about Business, Property & the Economy This is a paid press release and does not necessarily reflect the views or opinions of Credit.com. Please note that any information provided is for educational purposes only and should in no way be considered legal advice or tax advice. The Free Publication includes information on: Free Phone Self-Help Guides Subscribe Today to the Credit.com Podcast.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Jacksonville Florida 2025 1040, keep away from glitches and furnish it inside a timely method:

How to complete a Jacksonville Florida 2025 1040?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Jacksonville Florida 2025 1040 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Jacksonville Florida 2025 1040 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.