Award-winning PDF software

Joliet Illinois online 2025 IRS 1040: What You Should Know

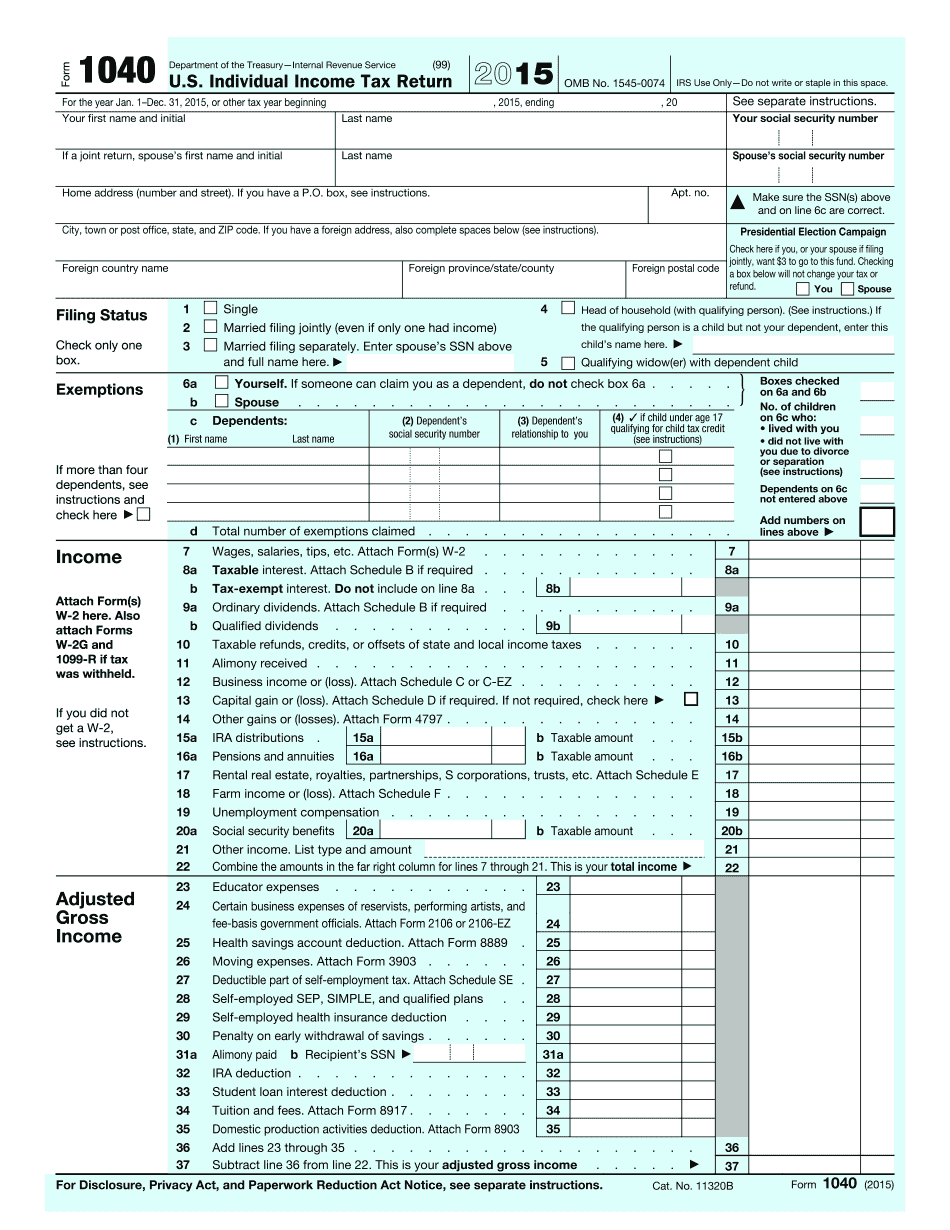

Also, if your business, farm, profession, or trade includes sales of tangible personal property, and your total sales for the year total more than five hundred dollars (500), you qualify for Special 1. You can't claim business expenses, such as the cost of property or equipment (such as office or computer equipment) even if you also itemize. Also, you can't deduct business meals or lodging expenses, though you can deduct some other expenses (such as travel) and use any reimbursements you receive. A “provisional” year-end balance shows your adjusted gross income after all deductions for any allowable tax credits are taken. In calendar year 2021, the provisional year-end balances will be posted to IRS.gov and will take approximately 72 hours for processing. Once posted, you can check on your refund online or on a paper by using the following link: Filing your tax return using Tax Filing Software — IRS Filed on paper, it takes less time and is accurate for the federal tax return. You can print a copy of the form and hand it in at any IRS office. What to include in your IL-1040 Illinois taxpayers can claim up to three items on the tax return, including: Personal Exemptions, (up to 6,000). Taxpayers can claim up to three items on the tax return, including: Social Security and Medicare (up to 2,000). The maximum amount you can deduct on the tax return depends on how much you have withheld from your paycheck, the number of dependents you have, and the income level of each dependency. Medical expenses (up to 7,800). Taxpayers can claim up to three items on the tax return, including: Pensions, annuities and pension-like payments (up to 17,200), Social Security Disability Insurance (up to 7,200) and other Federal means-tested disability benefits. Child and dependent care expenses (up to 4,800). Taxpayers can claim up to three items on the tax return, including: Medical expenses related to a disability received (up to 3,800) and child care expenses (up to 3,400). Home rental payments (up to 12 percent of the rent) and mortgage payments.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Joliet Illinois online 2025 1040, keep away from glitches and furnish it inside a timely method:

How to complete a Joliet Illinois online 2025 1040?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Joliet Illinois online 2025 1040 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Joliet Illinois online 2025 1040 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.